Not all plans will allow you to roll over IRA assets. Contact your former employer to provide instructions.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

How To Take Money Out Of A 401 K Plan

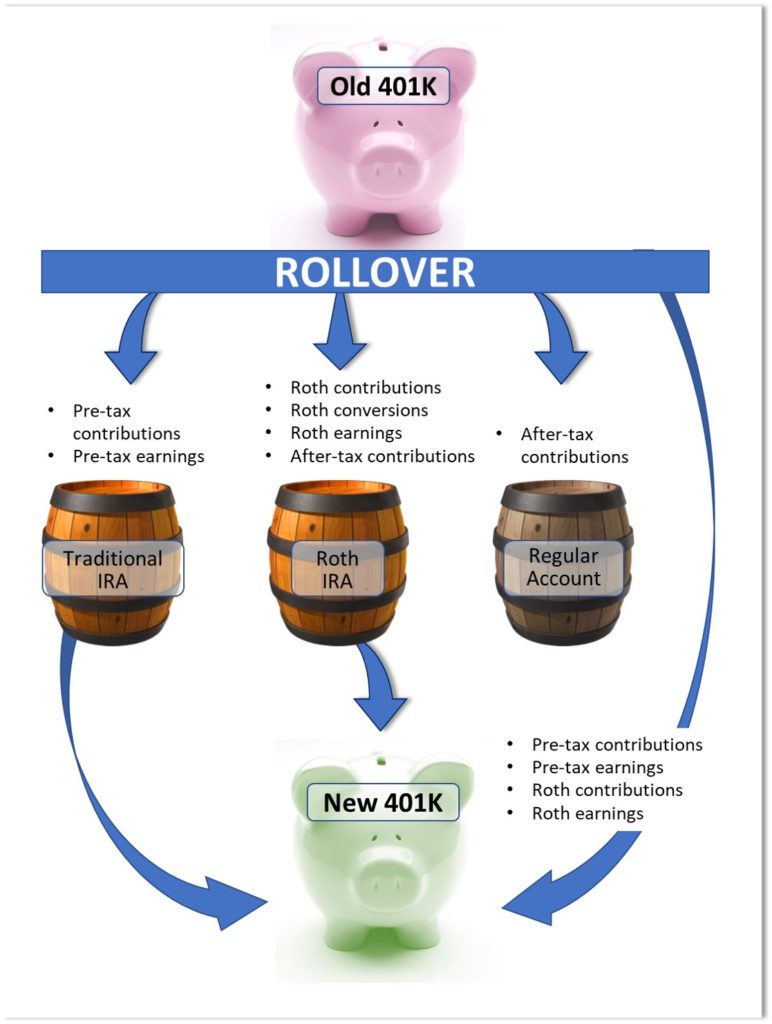

You can roll over from a traditional 401k into a traditional IRA tax-free.

Can a 401k be rolled over to an ira. Traditional or Rollover Your 401k Today. Ad An Account Rollover Can Help You Keep Your Portfolio Diversified. But dont forget about the taxes.

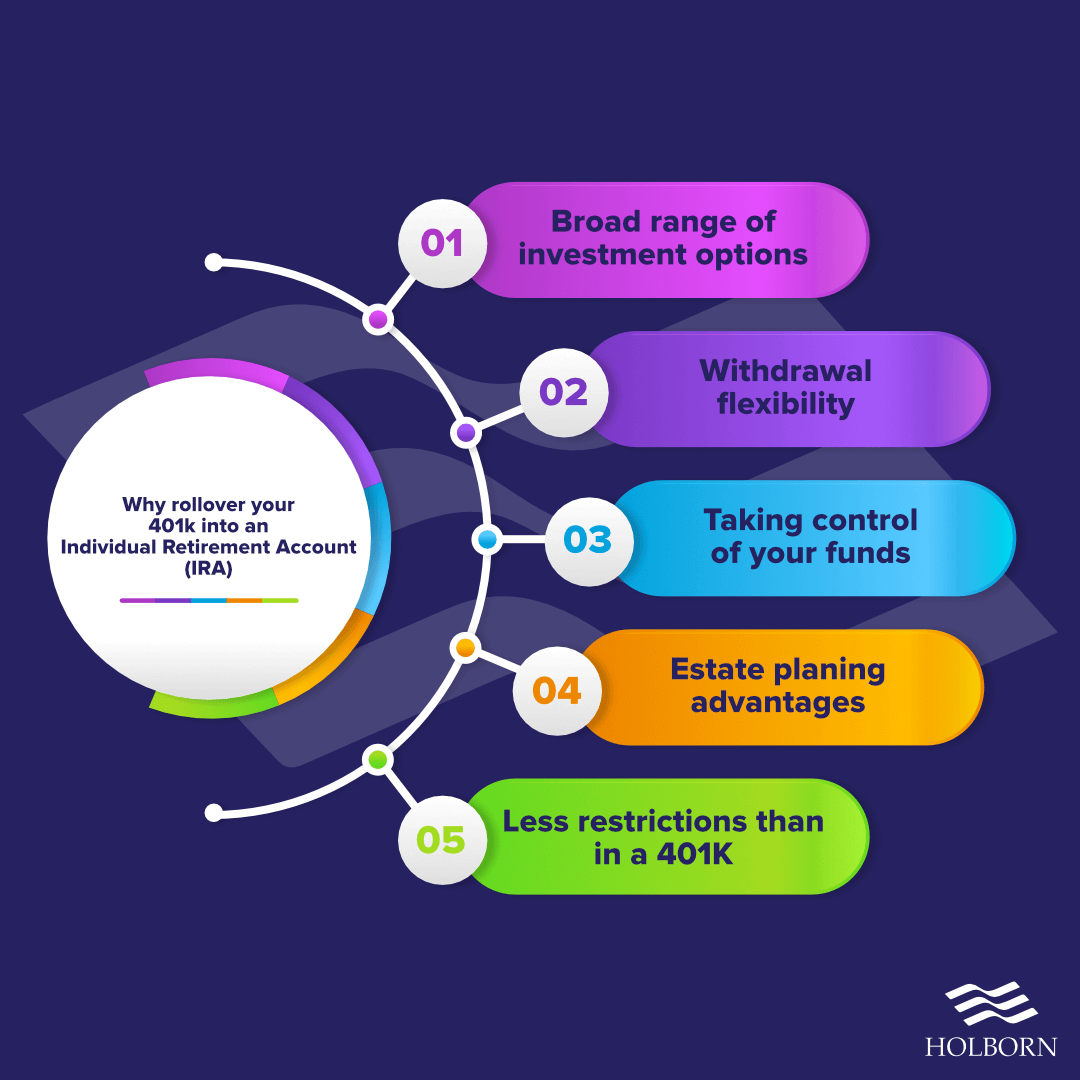

For most employees it is a smart choice to roll over a 401k into an IRA. Your investments will remain tax-deferred until you withdraw them. A 401k rollover allows you to transfer money from an old 401k account to an Individual retirement account or another 401k plan.

Same goes for a Roth 401k-to-Roth IRA rollover. Hi I am hoping someone can help clarify regarding 401k options where the owner is deceased and no beneficiary designated. You generally can move funds to or from a SEP IRA into or from a Traditional IRA or other pre-tax plan like a 401 k or 403 b.

Yes Its Called an In-Service Rollover. You cant roll a Roth 401k into a traditional IRA. Ad Roll Over Your Old 401K to an IRA in 3 Simple Steps.

There were no designated beneficiaries on the account and the plan documents state the funds must be rolled over. Beyond the type of IRA. Taxes will be withheld from a distribution from a retirement plan see below so youll have to use other funds to roll over.

You need your IRA custodians name Vanguard for example your account number and a delivery address. Open an IRA Explore Roth vs. Roll over your old 401k into a TDAmeritrade IRA.

IRA Rollover to 401 k If your survivor is inheriting retirement funds in an IRA the rules are similar but are also subject to an employers guidelines. Ad If you have a 500000 portfolio download your free copy of this guide now. It may not have dawned on you that you can roll over some of your 401 k to an IRA while youre still working for the employer that sponsors the 401 k.

You will have access to a wide range of investments including mutual funds. Content updated daily for can 401k be rolled over to ira. 401k Rollover to Roth IRA.

Ad Get Up To 600 When Funding A New IRA. You can use this sample text. If you do have an IRA you can roll your 401k money over into it.

However there will be tax consequences if you roll over money from a. Roll your old 401k over into your new employers 401k plan. A relative is executor of an estate where the unmarried deceased party held a 401k account totaling close to 1 million dollars.

Possible reasons to roll over funds to or from your SEP IRA. Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K. You can roll over money from a 401k to an IRA without penalty but must deposit your 401k funds within 60 days.

Key reasons for a 401k rollover to IRA. The first step is checking whether your employers 401k plan accepts IRA rollovers. Rolling over may be beneficial if you can consolidate retirement funds into a low-cost 401k plan.

Ad Looking for can 401k be rolled over to ira. Explore Your Choices For Your 401k Now. If your new employer offers a 401k this might be a good option.

Id like to roll my 401 k over to an IRA. Wider Range Of Investments Than Most Employer-Sponsored Plans Typically Offer. Surviving spouses can simply take over.

Content updated daily for can 401k be rolled over to ira. Ad TIAA IRAs Provide Easy Account Opening Flexible Funding Options. Ad Looking for can 401k be rolled over to ira.

Ad Build Your Future With a Firm that has 80 Years of Retirement Experience. 60-day rollover If a distribution from an IRA or a retirement plan is paid directly to you you can deposit all or a portion of it in an IRA or a retirement plan within 60 days. How to Complete an IRA to 401k Rollover.

Ad Roll Your Investments Into A Fixed Annuity For A Financially Secure Retirement. For those with high incomes the 401k rollover to a Roth IRA can serve as a backdoor into a Roth tax treatment. You can roll over an IRA to a 401k.

How To Transfer Or Rollover Funds To Your Ira Self Directed Ira Handbook

Rolling Over A 401k To An Ira The Reformed Broker

What To Do With An Old 401 K 4 Choices To Consider Ticker Tape

Should I Rollover My 401 K Into An Ira Absolutely

The Complete 401k Rollover Guide Retire

How To Do A 401k To Ira Rollover

How To Roll Over A 401k San Diego Softwealth

The Complete 401k Rollover To Ira Guide Good Financial Cents

Should I Roll Over My 401k Into An Ira How To Decide My Money Blog

Roll Over Ira Or 401 K Into An Annuity Rollover Strategies

Should You Rollover That Old 401k Genwealth Financial Advisors

Rollover Revisited Why Sticking With A 401k May Be Better

Rolling Over Your Nest Egg 401 K To Ira Ticker Tape

The Complete 401k Rollover Guide Retire

Why Roll Over Your 401 K Into An Ira Holborn Assets Spain Holborn Assets Spain

What Is A Rollover Ira Rollover Ira Ira Rollover Nua

What Is A Rollover Ira Retirement Rollovers Explained Youtube

401 K To Ira Rollover Rules Under The Cares Act Ira Financial Group

Post a Comment

Post a Comment